Introduction

I'm Herv, also known as HervTrades. I've been trading since 2019 and transitioned to full-time trading in early 2021, and since then I've carved out a niche in small to mid-cap trading with a long-bias, accumulating over seven figures in profits along the way. I feel that my biggest strengths are my expertise in technical analysis and my multi-timeframe trading approach. Over the years I’ve been a member and mentor in several trading Discord communities and regularly share insights and educational content on Twitter. Despite ups and downs, I’m proud that I've developed a strategy that works well for me after years of experimentation and refinement.

Who this is for

This exhaustive list includes tools that are most commonly used by the best and most talented traders I know. Note that all of this is not required to succeed — no, you don’t have to be surrounded by monitors to make money (as I’ve learned from trading on a laptop on vacations) but they sure can be helpful. This guide will be most beneficial for aspiring or active day traders who seek to gain a head start or better understanding of the tools available. I understand that there are countless alternatives to these tools as well as other software & hardware that others might find useful; however, I feel that all of these things work best for me. Your results may vary.

Disclaimer: I’m not a a financial advisor or licensed professional. All of the following information is for educational and entertainment purposes. The links with an asterisk are affiliate links where I’ll receive a small commission if you so choose to subscribe to these services.

Hardware

Mo’ money, mo’ screens. And other hardware things.

Computer

When it comes to choosing a computer for trading, I suggest opting for a Windows-based system rather than an Apple/Mac. This recommendation stems from two main factors: first, a significant number of trading applications are exclusively designed for Windows; second, these programs tend to perform better on Intel/AMD processors.

As far as specs go, I would recommend the following at a minimum:

Mid-tier CPU like Intel Core i5-12600K or Ryzen 5 5600

16GB RAM

Mid-range GPU such as Nvidia GeForce RTX 4070 or AMD Radeon RX 7800 XT, depending on number of screens and other needs such as gaming capabilities.

Monitors

When I have friends over to my house for the first time, my office is the first room they go into from the front door. Even if they know I trade but aren’t really sure of the specifics, they’re always shocked at my setup. Comments usually include, “wow, this is pretty serious!” or “what would you need so many screens for?”. It does look pretty intimidating to non-traders, but yes, there is a use for having so much screen real estate. I have the Dell S3220DGF as my main monitor for multi-use purposes, but the specs don’t really matter as much as just having them.

Stream Deck

The Stream Deck is truly an essential tool for my trading success, and I can't imagine trading without it. From opening all my trading applications with the touch of a button to executing trades, the capabilities of this device are truly limitless. I’ve probably clicked those buy and sell button a hundred thousand times over the years and they all still work perfectly.

Headphones

Whether you’re voice chatting with friends on Discord or gaming, a good set of headphones can make your experience comfortable and enjoyable. I’ve been using SteelSeries for as long as I can remember, and they have yet to fail me. They are super comfortable and easy to set up. Currently, I’m using the Arctis Nova 7’s.

Standing desk

Thanks to my Uplift desk, putting in long hours in front of the screens doesn’t have to suck. I don’t stand up at my desk a ton of the time, but love having it as an option, especially during after-hours while I might just be studying or journaling. Sitting for hours at a time encourages the muscles on the front of the body to shorten and tighten, and even standing a little bit during the day can help.

Eeros

While running an ethernet line straight from your router to your PC is preferred, if you aren’t able to or don’t want a cable running through your house, I prefer the Eero ecosystem to solve that problem. The mesh wifi network not only gives you better internet throughout your home, but you can hardwire an Eero router directly into your computer for lightning fast internet speeds. I’ve been running the Eero 6+ system in my home for over a year with no issues.

Philips hue

Depending on your environment, you might benefit from room/ambient lights to reduce strain on your eyes from the computer screens. Of course a plain lamp would work, but a splurge option is the Philips Hue system which I have installed throughout my house. Change the vibe on the fly, control from your phone and even your Streamdeck.

Battery backups/UPS

Having a battery backup (or two) is crucial for day trading, as it ensures that you can continue executing trades and managing your positions during unexpected power outages, keeping you safe from potential disaster. Because my trading setup and router are in different rooms, I have a battery backup for each.

Software

Brokers

When it comes to brokers, there are dozens of options that all have their own strengths, weaknesses and specialties. For my main broker I have been using Schwab (formerly TD Ameritrade) with the ThinkorSwim trading platform since the very beginning of my trading journey. Here are some pros and cons:

Pros:

Schwab is one of the biggest and most well-known banking/brokerage companies in the world.

ThinkorSwim platform is ubiquitous and the preference for many traders, with a plethora of user-made scripts, plug-ins and indicators.

Offers arguably the best price improvement fills out of any broker, with many fills occurring between the spread.

Cons:

ThinkorSwim platform can have issues at times such as delayed/lagging orders, can be unresponsive or even the occasional crash.

Schwab can restrict/limit the number of shares you can buy at a time, but won’t tell you and its up to you to figure out what size lots you can take.

Schwab will NEVER own up to brokerage or platform issues or reimburse for lost funds due to their own errors. In nearly 5 years of trading, I’ve never received a reimbursement for platform issues.

HTB brokers

While I’m not going to dive deep into this topic, an essential part of my trading includes having a HTB (hard to borrow) broker. There are two main reasons for this: the DAS software that delivers a lightning-fast Level 2 and Time and Sales, and allows me to locate shares to short when the situation calls for it. The most common HTB brokers are Centerpoint, Cobra, Guardian (my personal preference) and Interactive Brokers.

Pros:

Far more customizable options; can set daily max loss, highly customizable hotkeys, route selections, order types etc.

Instantaneous executions and fills.

Generally better customer service and support.

Cons:

Commissions , locates and fees can eat into a huge portion of net profits.

Software can take some getting used to.

Theoretically limitless loss potential; shorting can be extremely dangerous and losses can escalate quickly.

Finviz (paid)*

Finviz is one of the primary tools I use outside of my trading platform. It offers a wide variety of scanning tools, financial, descriptive and data information for all listed stocks. Here you can find sector, float, market cap, and just about any stat you could want.

How I use it:

I enter a specific search criteria, such as over $1, relative volume over 1, current volume over 1 million, change up at least 5%. Finviz then takes this criteria and displays the charts in your preferred time format and sorted by which order you choose. For me I start with the daily chart in the morning and switch between that and the 5 minute chart throughout the day. The charts can be refreshed automatically every 10 seconds or 1 minute.

Dilution Tracker (paid)*

Dilution Tracker has become a staple in small cap trading within the last couple of years, and for good reason. This service provides up-to-date information related to dilution, filings, accurate float and much more. With dilution being such an important part of small caps, its great to have a tool that allows you to quickly look into limiting factors within potential plays of the day.

eSignal (paid)

While this application may be overkill to some, I use eSignal to display 10 & 15 second charts of the current symbol I’m trading. With scalping being a major strategy of mine, these micro timeframes along with the instant responsiveness of the candles, allow me to read and react to price action happening on a sub-1 minute timeframe. I use the Microsoft Powertoys “always on top” tool to overlay this window on top of my ThinkorSwim. I use the “Signature” subscription they offer.

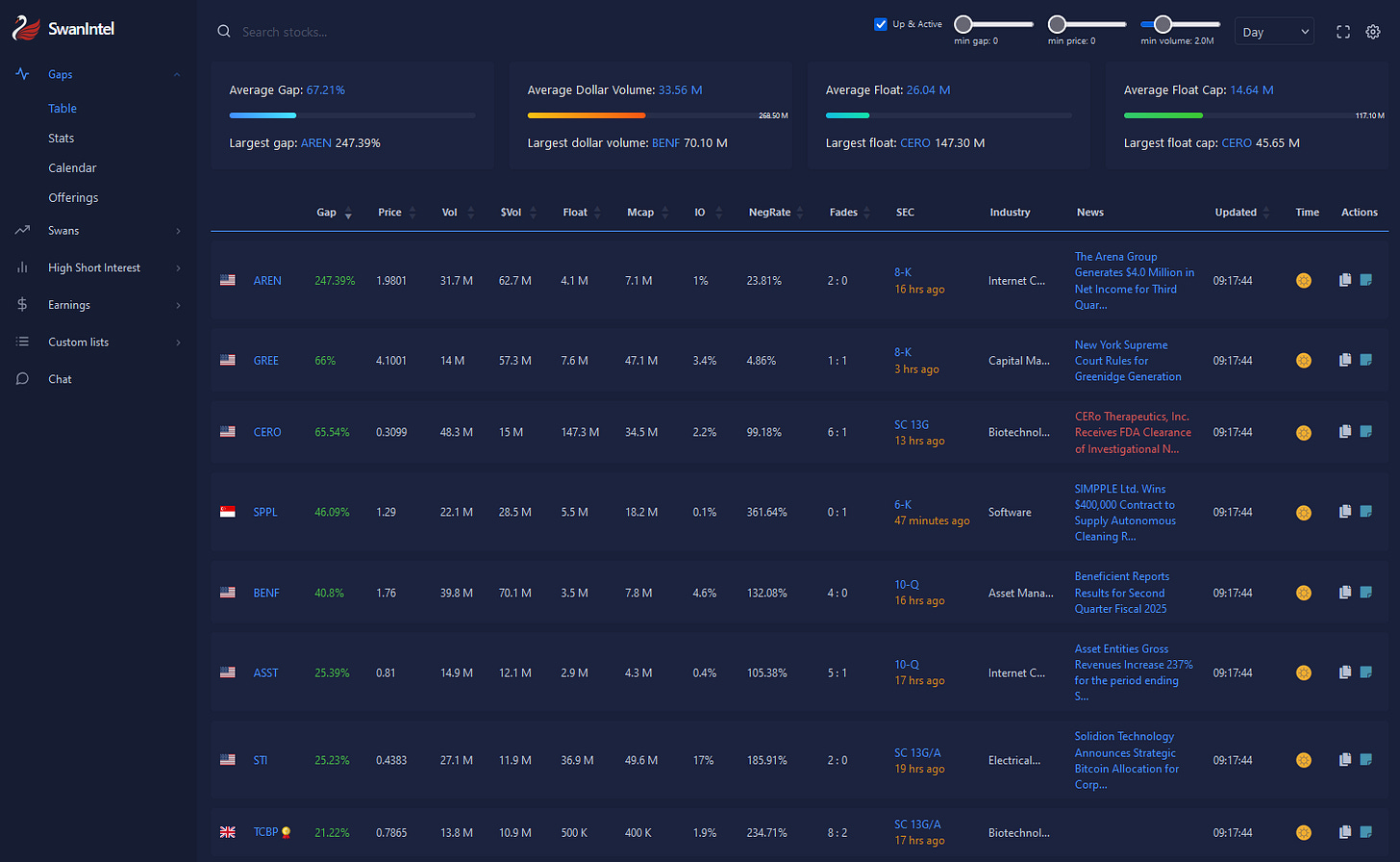

SwanIntel (free)

Perhaps the newest resource in the realm of trading is SwanIntel. Currently a free website, SwanIntel provides critical information on daily gappers and recent runners, all within an easy to use UI.

Data tracking/Backtesting Services (paid)

Another part of gaining edge is utilizing datasets and backtesting to push the odds further into your favor. Services like Flash Research and Quanted gather historical stats on tickers and outputs a multitude of information that help predict how stocks are likely to perform.

Tradervue (paid)*

Arguably one of the most important aspects of finding success in trading is journaling. For over 3 years I have used Tradervue to import trades, track winners and losers, and gather data on all aspects of my performance. It's also a great way to keep track of your daily, weekly, monthly and yearly P/L.

Youtube

Youtube is undoubtedly one of the best resources for learning about trading, and it’s a big part of my journey in becoming successful. I owe a great debt of gratitude to those who took the time to make educational content for everyone. Below are some great channels to check out:

David Hanlin-The Laptop Legend

Zendoo

This is a free live scanner on Youtube with only a 4 second delay that sounds out high-momentum stocks each day. With an advanced array of visual modules and built-in halt timers, this is a product I couldn’t have built myself.

Now I know some people might argue that the delay and the inability to customize the scanner are disadvantages, but having used both this and Trade Ideas (a paid scanning subscription), I’ll take this tradeoff for the difference in cost as well as ease of use.

X

X (Twitter still, to me) is the social epicenter for traders and stock market “experts” alike. Jokes aside, X is a great place to learn from others and find a community that fits your style of trading. X is also one of the best sources for breaking news. I would suggest finding traders that most fit your style and who consistently provide the most value to their followers. For a good place to start, you could go through my “following” page for some good recommendations.

Discord

Discord is arguably the most valuable resource for traders to share ideas, find educational material, and connect with each other. There are hundreds of trading-related servers that focus on specific types of trading, ranging from thousands of members to just a few in smaller groups. I have personally found some of my best friends and most talented traders through Discord rooms. A great feature that I use every day is Discord voice, where I can chat live through my headset with other members of the server.

Perplexity

I find Perplexity to be an increasingly helpful resource as a day trader. I use it to analyze earnings reports, understand market trends and ask it just about anything.

Evernote

Aside from journaling and reviewing your trades, the next best thing you can do as a trader is catalog different setups with charts, descriptions and annotations. For me, I log the ticker, date, news, float, market cap as well as screenshots with multiple timeframes and annotations if necessary. You can add these into specific groups as well as tags to keep your logs organized and easily accessible.

Miscellaneous tools

ShareX (free)

The best app to quickly screenshot, annotate and share images. There are many options to screenshot quickly and accurately.

Powertoys (free)

Microsoft Powertoys is a scarcely known suite of tools that just makes life so much easier. A gadget I frequently use is “always on top,” where you can pin any window to the front of the screen so it can't be covered up by other windows or applications. Another is “fancy zones,” which allows you to easily snap windows into preset zones. It includes an array of other utilities that help streamline workflows.

OBS (free)

OBS is a favored screen recording application among streamers, gamers, and traders alike. I utilize it daily to capture my screen for several reasons: to review trades in real-time as they occur and as a safeguard in case any issues arise with my brokers or trading platforms. I like having the ability to choose recording format and resolution as well as multiple sources. Best of all, it's totally free and without ads.

Razer/Ghub macros/hotkeys

A frequently overlooked productivity and efficiency hack is programming macros and hotkeys on your mouse, when applicable. For instance, my Logitech mouse features up to 14 buttons that can be programmed for various actions, including copy and paste, application switching, screenshot capture, and more. Any tool that saves you time can be the difference between successfully executing a trade and missing out.

I hope this guide is helpful whether you are a seasoned trader or just beginning your journey. I owe so much to the friends & fellow traders that have been kind enough to share bits and pieces of this wisdom with me over the years, and am lucky to still be on this amazing journey all this time later. Cheers to having the best job ever.

-Herv

First 🔥

I don’t need 6 screens to analyse 1 stock. All I have is a brain.